Maybe your family has outgrown that starter HDB BTO flat and you’re now looking to upgrade options for a better place.

Or maybe you’ve got a fully paid HDB and are thinking of getting a condo for your golden years.

Assuming you’ve already fulfilled the Minimum Occupation Period (MOP) for your HDB, you’re now free to explore your options.

These could be:

- A bigger/nicer resale HDB flat in a more mature estate

- Another HDB in a better location (particularly if you’ve been eyeing a particular primary school for your kids)

- A new launch condo that will T.O.P. in a few years

- A resale condo or landed property that you can move into immediately after the sale is completed

Since your home is such a huge investment, you want to make sure all the dollars and timelines add up and that it makes sense to uproot your family.

After all, you don’t want to be caught in a horror story like this one, where a couple was asked to pay over $84,000 in cash upfront for their HDB.

In this article, we’ll talk about the financial aspects of upgrading – but we’ll also highlight all the traps you should avoid as you plan the purchase of your new home while upgrading from your HDB flat.

Traps to Avoid When Upgrading from HDB:

- Not fulfilling the Minimum Occupation Period (MOP) for your HDB flat.

- Not checking up on your current property’s value before you shop around for the new property.

- Overestimating the amount of cash you’ll get from the proceeds of the sale.

- Overextending yourself with the loan for your new place.

- Not accounting for the higher cash payment required for condos.

- Thinking you can avoid ABSD if you sell your current property soon after buying the new one.

- Trap 7: Not factoring in renovation or ongoing costs for the new property.

- “I can use CPF to cover the BSD/ABSD.”

- “I can apply for extensions with the payment of BSD / ABSD.”

- “I can buy the condo under my spouse/child’s name to avoid the ABSD.”

- “I can transfer my share of the house to my spouse/child, then purchase the additional property.”

Upgrading Trap 1: Not fulfilling the Minimum Occupation Period (MOP) for your HDB.

Upgrading Trap 1: Not fulfilling the Minimum Occupation Period (MOP) for your HDB.

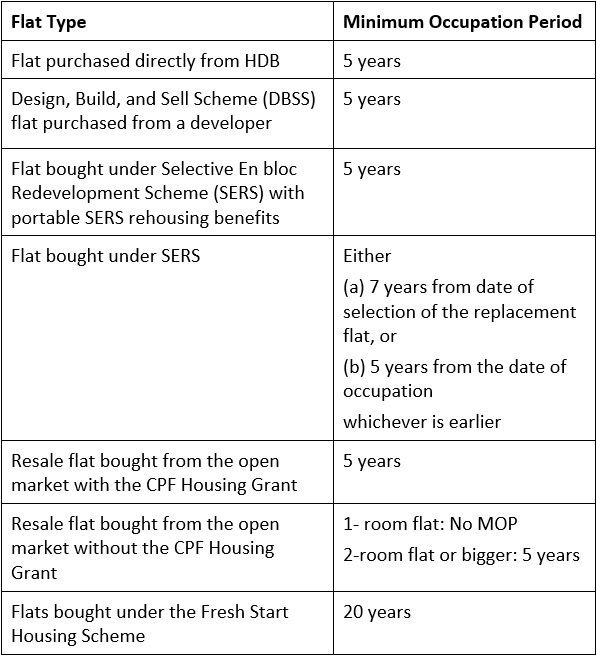

Most people know that they have to fulfill the MOP for their HDB flats before they can sell it off or purchase private property. For most people, that also means that you have to stay in your HDB flat for 5 years before you upgrade to another dream home.

The standard MOP is 5 years (with a few exceptions). Check the table below to figure out your MOP:

However, what you may not know is how the MOP is calculated.

Under HDB guidelines, you’re required to physically occupy the flat for it to be counted towards the MOP. That means if you moved your family overseas for a year, that year doesn’t count towards the MOP.

Upgrading Trap 2: Not checking up on your current HDB flat value before you shop around for the new property.

Upgrading Trap 2: Not checking up on your current HDB flat value before you shop around for the new property.

If you’ve got the cash to consider upgrading or purchasing another property without selling off your current HDB flat, then this doesn’t matter so much.

But if you’re counting on using the sale proceeds to pay for the new house, then you’d better make sure your property gives you enough value. You can check the average market rate for homes in your area via the HDB Resale Portal.

Hopefully, your home has appreciated in value since the time you bought it. (Read also: Increase Your Property’s Value – and Sell It FAST).

But if it hasn’t gone up by much, then you may be selling at a loss (after accounting for inflation).

Don’t forget that on top of paying off any home loans, you’ll have to refund the CPF used plus accrued interest, which can add up to quite a bit over the years.